qyld stock dividend per share

Or a high dividend yield ETF such as the Vanguard High Dividend Yield ETF since QYLDs. Feb 212020 - DIVIDEND ANNOUNCEMENT.

Qyld A Sell Now A Buy Later Nasdaq Qyld Seeking Alpha

For example if a companys dividend yield is 7 and you own 10000 of its stock you would.

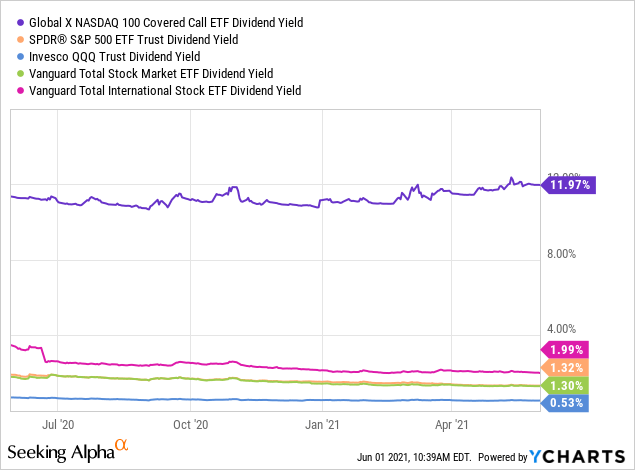

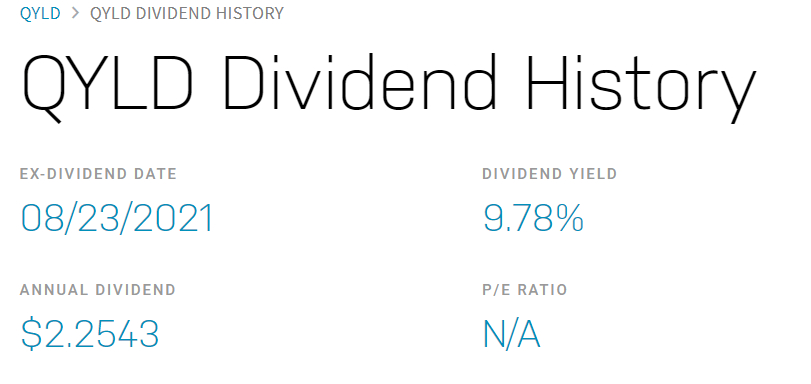

. Touch device users explore by touch or with swipe gestures. QYLD is popular because this allows the fund to have a distribution yield upwards of 10 that pays monthly making it attractive to income investors. 26 rows QYLD Dividend.

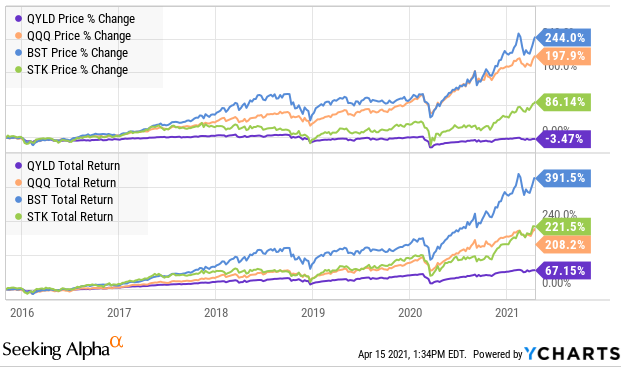

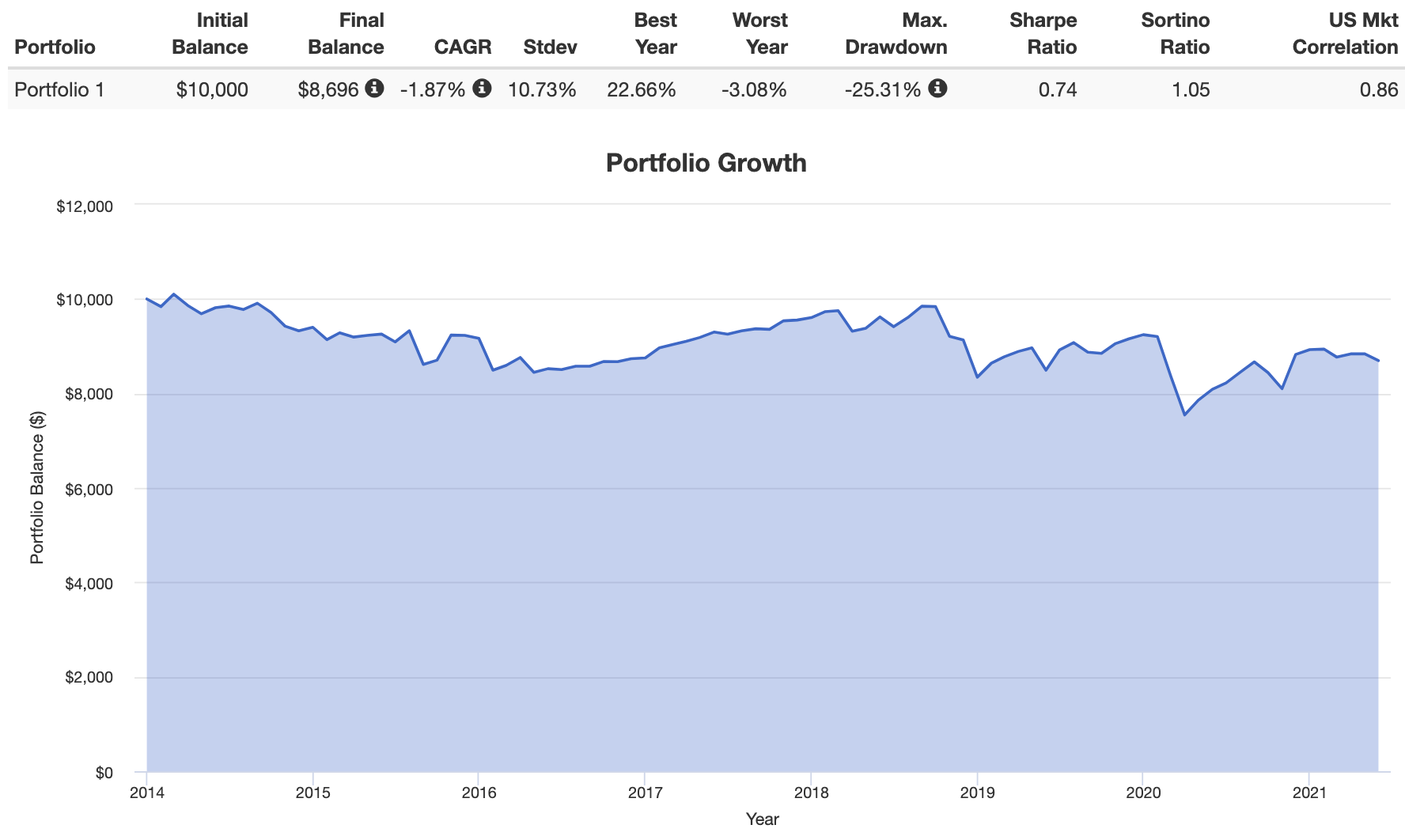

Over the long term even with DRIP QYLD will not come close to the historical performance of a US. Ad More Trading Hours More Potential Market Opportunities. The 5 year dividends per share compound annual growth rate for QYLD stock is 881.

The last monthly distribution amounted to 01735 per share. Dividend amount recorded is an increase of 00074 from last dividend Paid. The TTM dividends per share for QYLDstock is 271as of 5232022.

Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Feb 112020 - 52 WEEK HIGH.

The dividends per share for QYLDstock is 018as of 5232022. View 4000 Financial Data. 01809 for July 18 2022.

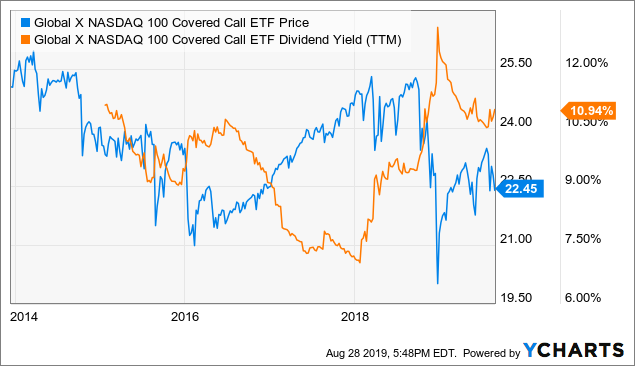

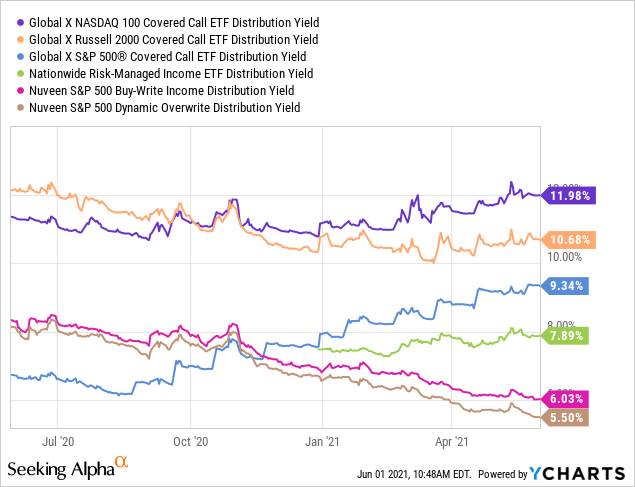

QYLD charges a fairly hefty 060 for this strategy. Yes the covered call ETFs yield a much higher than average dividend and its monthly which is very appealing but context matters. Is QYLD a Good Dividend Stock.

NASDAQQYLD Dividend Payment Schedule. Over the five years the investor collects about 243 per share in dividends each year or just over 1036 and a 103 dividend yield. Nasdaq 100 Covered Call ETFGlobal X Funds NASDAQQYLD on 07152022 declared a dividend of 01809 per share payable on July 26 2022 to shareholders of record as of July 19 2022.

The ex-dividend date of this dividend is Tuesday June 21st. The fund holds stocks in the NASDAQ 100 and writes 1-month at-the-money calls on them. QYLD on 02-21-2020 declared a dividend of 02377 per share.

What is qyld dividend. As well as tech stocks and a few other. Trade 245 at TD Ameritrade.

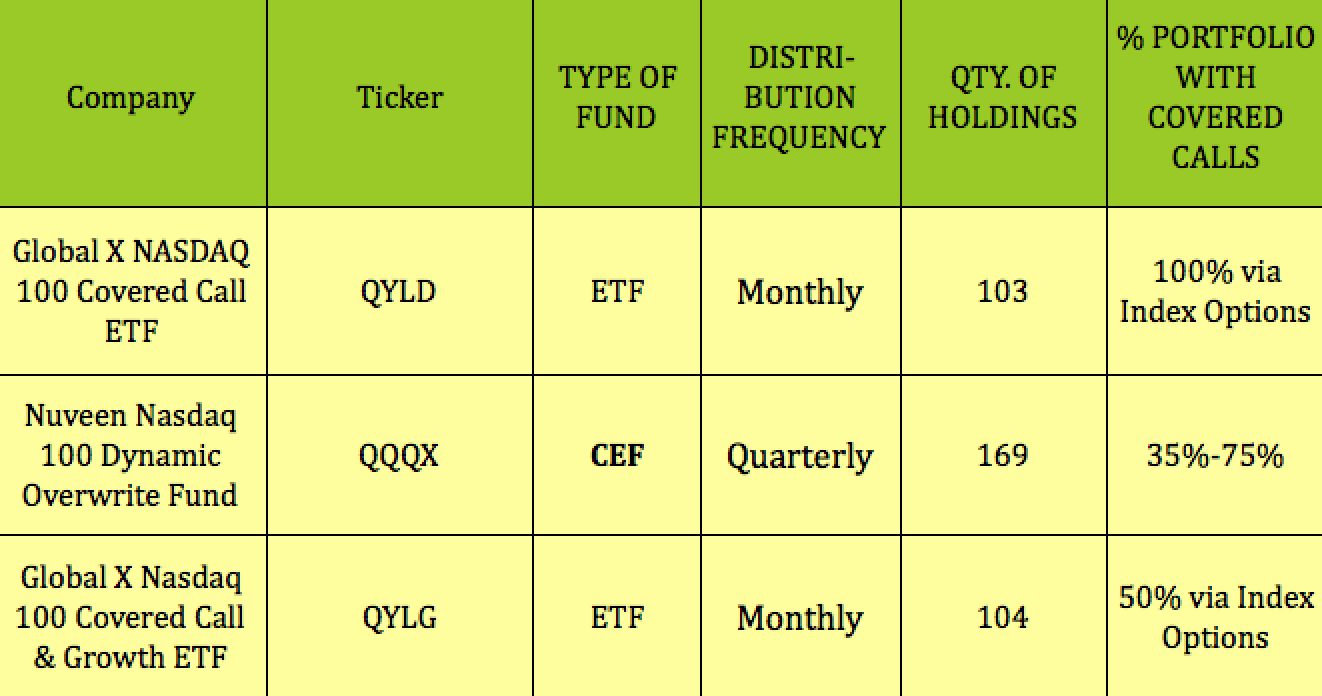

Nasdaq 100 Covered Call ETFGlobal X Funds NASDAQ. Ad See how Invesco QQQ ETF can fit into your portfolio. The Global X Nasdaq 100 Covered Call ETF QYLD follows a covered call or buy-write strategy in which the Fund buys the stocks in the Nasdaq 100 Index and writes or sells corresponding call options on the same index.

What is the TTM dividends per share for Global X NASDAQ 100 Covered Call ETF QYLD. Today QYLD pays a dividend of 268 per share which is a forward yield of 1186 through a covered-call strategy for a low expense ratio of just 060. The CBOE NASDAQ-100 BuyWrite Index is a benchmark index that measures the performance of a theoretical portfolio that holds a portfolio of the stocks included in the NASDAQ-100 Index and writes or sells a succession of one-month at-the-money NASDAQ-100 Index covered call options.

What is the 5 year dividends per share CAGR for Global X NASDAQ 100 Covered Call ETF QYLD. Dividend yield is the percentage a company pays out annually in dividends per dollar you invest. This could indicate that the company has never provided a dividend or that a dividend is pending.

QYLD on 02-11-2020 hit a 52 week high of 2409. Nothing proprietary going on. What is the dividends per share for Global X NASDAQ 100 Covered Call ETF QYLD.

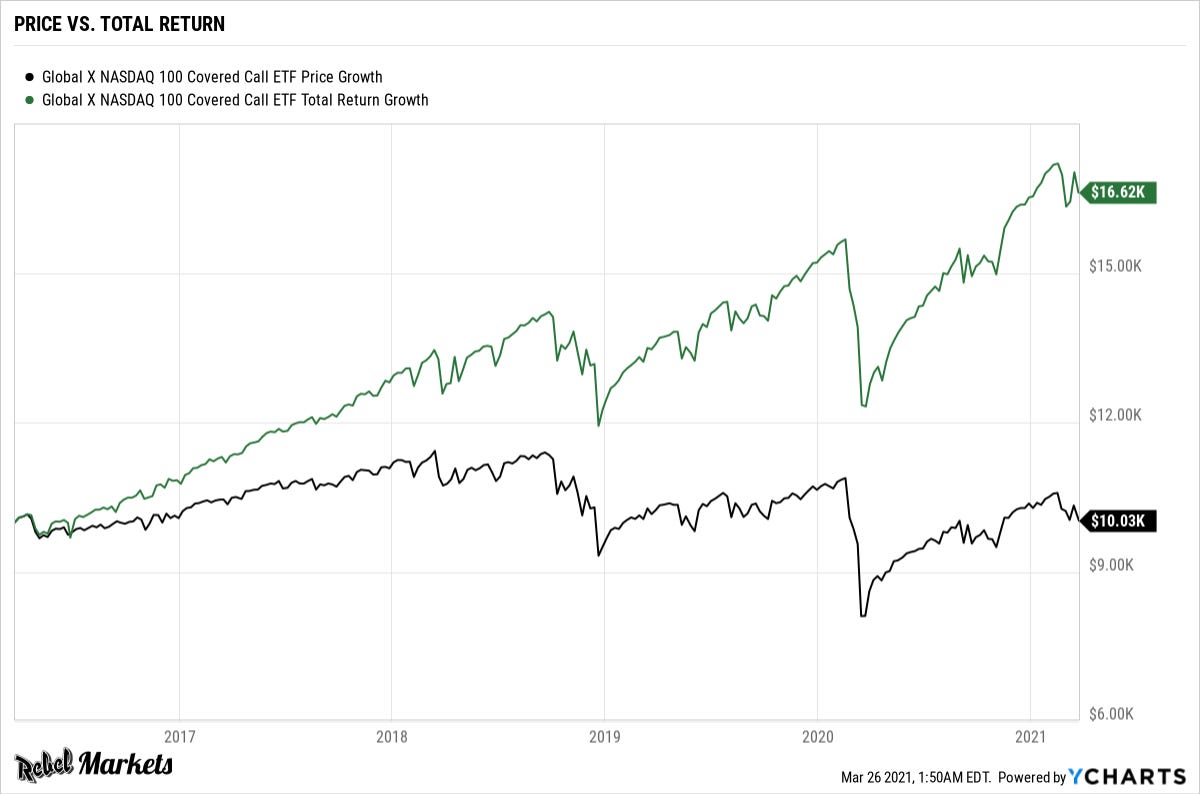

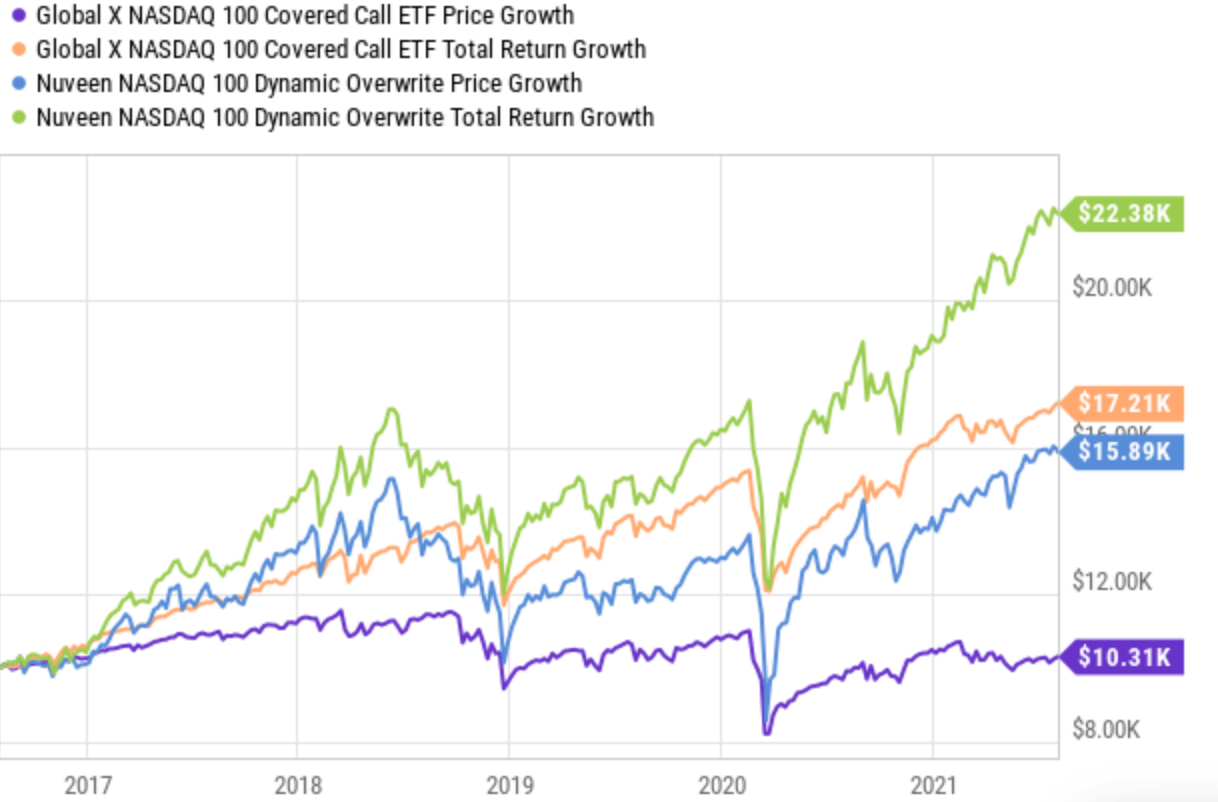

Market or SP index fund in total returns. Nasdaq 100 Covered Call ETFGlobal X Funds NASDAQ. Comparing Monthly Dividend Stocks QYLD and GAIN Side-by-Side.

Since the stock has fallen to 20 a share though the portfolio is only worth 8546 right now. Dividends are paid based on how many shares you own or dividends per share DPS. The 3 year dividends per share compound annual growth rate for QYLD stock is 302.

Current Dividend Payment per Share. Back to XYLD Overview. If youre an income investor QYLDs 1186.

Find the latest Global X NASDAQ 100 Covered Call ETF QYLD stock quote history news and other vital information to help you with your stock trading and investing. Lets assume you buy XYZ stock for 50 per share believing it will rise to 60 within one year. Find a Symbol Search for Dividend History When autocomplete results are available use up and down arrows to review and enter to select.

Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. QYLD has a dividend yield of 1566 and paid 271 per share in the past year. NDX calls for September 17 AM expiration at the 15000 strike have a bid of a little under 269 per.

Current Dividend Payment per Share. Dividend history information is presently unavailable for this company.

3 High Yield Etfs Paying Up To 11 To Avoid In 2021 Nasdaq

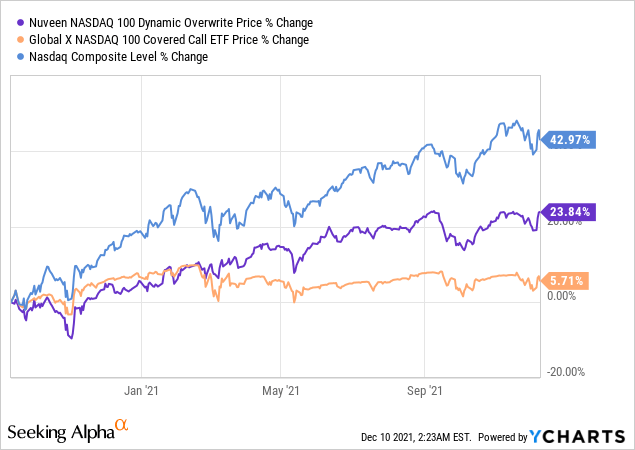

Qqqx Or Qyld Which Fund Makes More Sense One Year Later Seeking Alpha

Qyld 12 Tech Yield But There S A Hidden Outperforming Alternative Nasdaq Qyld Seeking Alpha

Understanding Qyld And Its 12 Dividend Yield For Beginners By Project Theta Mastering Stocks Medium

Global X Nasdaq 100 Covered Call Etf Qyld Covered Call Etf 11 9 Yield Seeking Alpha

Global X Nasdaq 100 Covered Call Etf Qyld Covered Call Etf 11 9 Yield Seeking Alpha

Is Qyld A Good Choice For Dividend Portfolios What To Make Of Its 14 Yield Seeking Alpha

Qyld Fantastic For Income Investors But There May Be A Better Option Seeking Alpha

Don T Buy Qyld Buy These Cefs Instead Nasdaq Qyld Seeking Alpha

The 5 Dumbest High Yield Funds Ranked Worst To Just Bad

Qyld Dividend Yield 2022 History Global X Nasdaq 100 Covered Call Etf

Understanding Qyld And Its 12 Dividend Yield For Beginners By Project Theta Mastering Stocks Medium

Qyld Avoid This Etf As A Long Term Investment A Review

Qyld Fantastic For Income Investors But There May Be A Better Option Seeking Alpha

Dividend Growth Stock Of The Month For October 2021 Nasdaq 100 Covered Call Etf Qyld Dividends And Income